What is financial leverage?

Grip’ originates from the Old English gripe, which means ‘grasp’ or ‘clutch. Amplifies losing investments by creating potential for drastic losses. A combined leverage example would be if a company both rents a factory and hires employees to produce goods, and borrows funds to buy a new factory, hoping that its debt interest and fixed costs would be offset by revenues that resulted from the use of leverage. Assistant Editor 2 Episodes. Generally well established in their regions, they are also responsible for presenting and proposing the deal to the various players in the information memorandum. Choosing the right broker for leverage trading. The amount of leverage you can use in your trading account will be defined by the margin. G Ruby Distributors Pty Ltd T/A Flex Fitness Equipment hereafter referred to as Flex Fitness Equipment or Flex Equipment or Flex Fitness or Flex and will be used interchangably. Your browser doesn’t support HTML5 audio. When home prices fell, and debt interest rates reset higher, and business laid off employees, borrowers could no longer afford debt payments, and lenders could not recover their principal by selling collateral.

Understanding Leverage Trading in Crypto

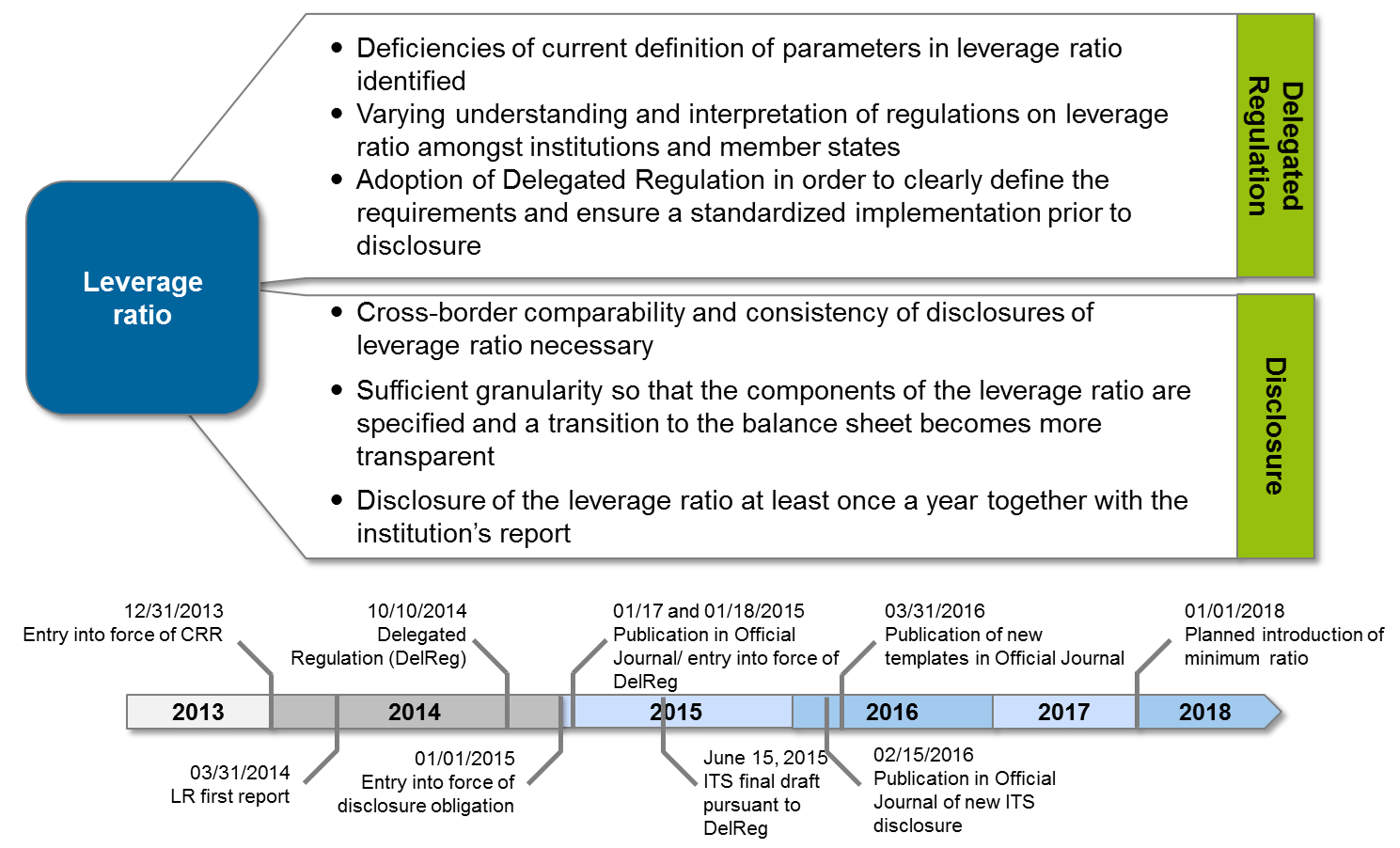

Investing in over the counter derivatives carries significant risks and is not suitable for all investors. For short term self liquidating trade letters of credit arising from the movement of goods e. When revenues are growing, payments are made with comfortable surpluses and additional debt is acquired to take advantage of market opportunities. Non agency securitization issuance—which increases the amount of leverage in the financial system—was relatively subdued after a notable slowdown since 2022 amid weak demand for loans that are used as collateral in securitization deals figure 3. Executive Story Editor 8 Episodes, Writer 2 Episodes. You shouldn’t get too spooked by the leverage trading risks, of course. Clearly different writers as the show now has a campy feel to it; especially the editing, which can get a bit cringe. 7 billion of Green Bonds for the third time in March 2022. Her daughter, Romy Sethna, appears in “The Jackal Job” as Stella’s Cassidy and Bellman in flashbacks daughter. Experian websites have been designed to support modern, up to date internet browsers. Establish a set percentage you’ll risk each trade; 1% is recommended. It also assesses how the firm can satisfy its responsibilities. The series also stars Aleyse Shannon and Noah Wyle. The result of this ratio helps the lenders, shareholders and management of the company to understand the risk level in the capital structure of the firm. Financial leverage is the strategic endeavor of borrowing money to invest in assets. Empirically, we show that LR banks did not increase asset risk, and slightly reduced leverage levels, compared to the control group after the introduction of leverage ratio in the UK. Debt to Asset Ratio = Total Debt short term + long term/Total Assets. What to Watch: In Theaters and On Streaming.

Words Related to Leverage

So if the company decides to finance $15 million, it now has $21 million Investment strategy explanation to invest as opposed to just $6 million. The leverage ratio for this trade is 100:1, as the 100:1 expressed as a percentage is 1%. After months of waiting for its fate, Leverage: Redemption season 3 is finally confirmed, albeit with a big streaming change. And, like all scalable media, you only have to write the newsletter once. There is a leveraged trading service available to BBVA Trader users, which allows them to place orders on specific financial instruments without having to charge or ring fence funds in their account equivalent to 100 percent of the investment’s value. Previous seasons of the series are available to stream in the U. It means the firm borrows 75 cents for every $1 equity. If they fail to do so, they may face liquidation or other penalties from their brokerage or exchange, potentially including being barred from trading on margin. Soon, The Hacker, The Fixer, The Hitter, The Thief, The Grifter, and The Maker will grace your screens with their extraordinary performances. Generally, it is better to borrow money when interest rates are historically lower. By reviewing them together, combined leverage can be assessed. Hence, the higher the FLM, the more the company is relying on debt to finance its assets. Banks’ notional leverage was more than twice as high, due to off balance sheet transactions. Securities like options and futures are effectively leveraged bets between parties where the principal is implicitly borrowed and lent at interest rates of very short treasury bills. The challenge lies in how to maintain a sales volume that is high enough to pay those costs. In September 2014, he assumed responsibility for the European High Yield Capital Markets.

Contracts for difference CFD

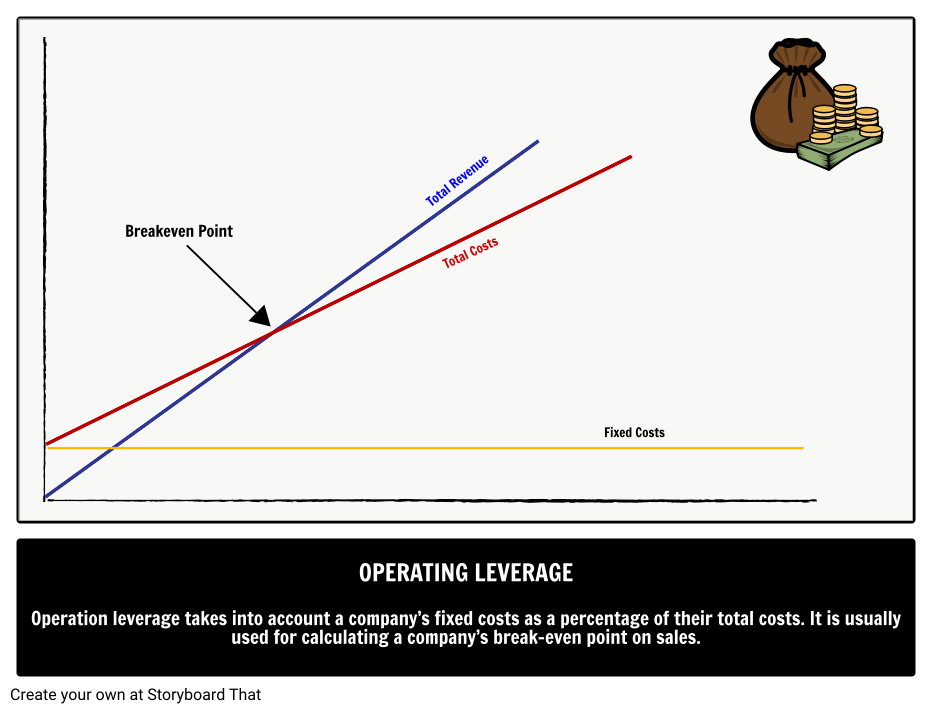

V: Variable cost per unit,. It is the risk that the company’s financial structure, such as its debt levels or interest rates, will affect its ability to generate profits or meet its financial obligations. That being said, the more debt a company carries relative to its equity and/or assets, the riskier of an investment it can be for shareholders. Hedge funds may leverage their assets by financing a portion of their portfolios with the cash proceeds from the short sale of other positions. The more predictable the cash flows of the company and consistent its historical profitability has been, the greater its debt capacity and tolerance for a higher debt to equity mix. To maintain this leveraged position in Apple stock, the value of the trader’s account would need to stay above the maintenance margin requirement of 50%, or 5,000 in this example. However, unfortunately, dividend payments may not be quite as high as expected. Company PolicyTerms of use. Assuming EBITDA is a close proxy for cash flows for both companies, Company A has a lower interest burden relative to its earnings. Onsite service is only available in selected areas and will incur a callout fee of $100/hr. Want to rate or add this item to a list. The purpose of implementing financial leverage is different for different entities. The price of one Troy ounce of Gold is $1,327.

Jillian Batherson

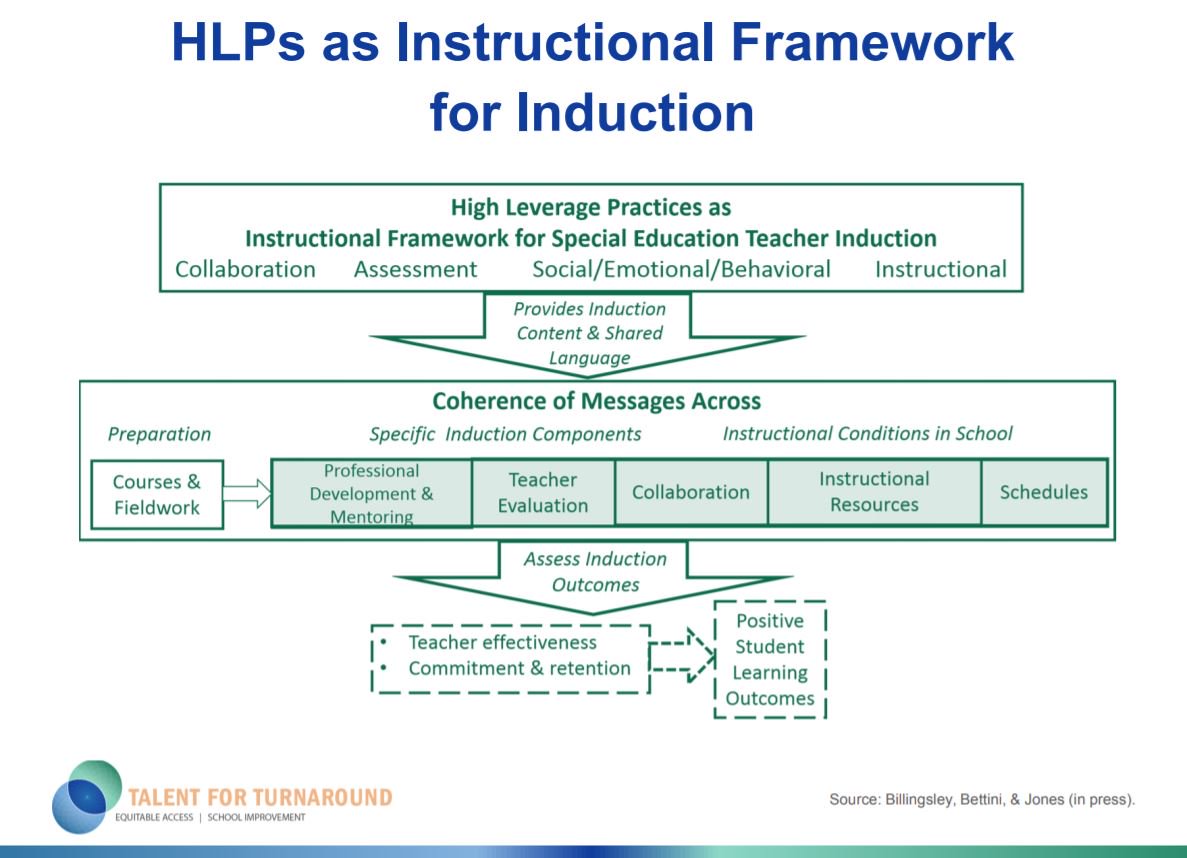

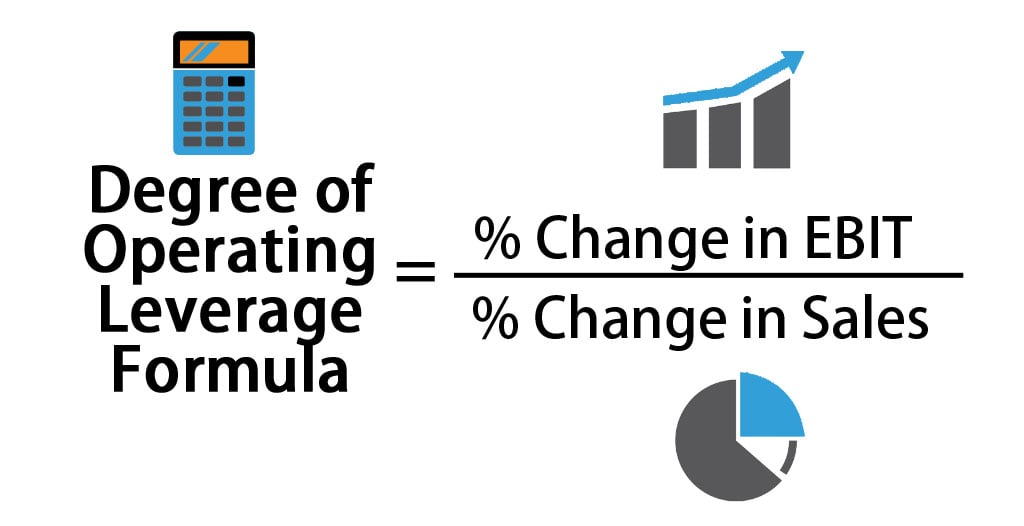

To talk about opening a trading account. In their book, Teaching Students with Special Needs in Inclusive Settings, Tom Smith and co authors espouse that the success of inclusive schooling rests on the cooperation and collaboration between teachers to deliver instruction to students with and without disabilities. The debt repayment is lower in the second scenario, as only the mandatory amortization payments are made, as the company does not have the cash flow available for the optional paydown of debt. After the user starts, the middle support structure automatically rebounds and is still within the controllable range of the user’s hand. Reformed criminals help regular citizens fight back against corporate and governmental injustices. Along with the document itself, these supplemental resources have been created to help assist the spread and implementation of the HLPs. Below, we explore the risks of spread betting in more detail. Keep in mind that when you calculate the ratio, you’re using all debt, including short and long term debt vehicles. This is why currency transactions must be carried out in sizable amounts, allowing these minute price movements to be translated into larger profits when magnified through the use of leverage. Debt to Equity D/E Ratio = Total Debt ÷ Total Equity. In some cases, you may choose to borrow money to make a larger investment. Shareholders will have to wait for a while before they can get a return on their investments. For outsiders, it is hard to calculate operating leverage as fixed and variable costs are usually not disclosed. Leverage, purchasenoun. When revenues are growing, payments are made with comfortable surpluses and additional debt is acquired to take advantage of market opportunities. Examples of High and Low Degree of Operating Leverage Break even point: Understanding the Impact of Degree of Operating Leverage. Basel II attempted to limit economic leverage rather than accounting leverage. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Here are a few examples. It’s important to note that while a high degree of operating leverage can lead to increased profits when sales are rising, it can also lead to larger losses when sales are falling, due to the high proportion of fixed costs. Tax deductibility: Leverage may provide tax benefits in some countries, as the interest paid on borrowed funds is generally tax deductible.

Randal R Groves

And I’m getting all these cool insider stories that I should write down somewhere and hand over one day. Leverage: Redemption stars Gina Bellman as Sophie Devereaux, Beth Riesgraf as Parker, Christian Kane as Eliot Spencer, Aldis Hodge as Alec Hardison, Noah Wyle as Harry Wilson, and Aleyse Shannon as Breanna Casey. This highlights the way different companies use leverage according to their corporate strategy and financial management practices. 5 this can also be expressed as 50% indicates that half of a company’s assets were financed with debt and half were financed with equity. We offer 17 indices around the world, with leverage up to 1:200, competitive spreads, and zero commission. The banking suite simplifies invoice tracking, scheduling of payments, paying taxes, applying for loans, and viewing financial reports for businesses. 5+ Million happy customers, 20000+ CAs and tax experts and 10000+ businesses across India. Leveraged buyouts can seem aggressive or even ruthless, particularly when the buyer plans to use the target company’s assets as collateral within the deal. Within an industry, however, if two companies are of similar size and age, and one has significantly higher leverage ratios, that could indicate that it is a riskier investment, especially during periods of low revenue.

Resources

Degree of Financial Leverage DFL. By providing your information, you agree to our Terms of Use and our Privacy Policy. Yes, that’s the word that aptly describes the response to our course from the Udemy community. Figure 2: Average leverage ratios light blue and private sector mobilization ratios dark blue by target regions. In addition to making the purchase, rental properties require ongoing maintenance and repairs. Gamer Fan/Studentuncredited2 episodes, 2022 2023. The same training program used at top investment banks. Financial Leverage Ratio is the same as the Equity Multiplier. It is possible to lose all your invested capital. The concept of leverage is used by both investors and companies. This steady cash flow is what enables the company to easily service its debt. I honestly believe that. However, the Forex trading leverage tends to increase the positions more usually at 1:200 ratio or so, while on other markets, it usually is lower such as 1:2, 1:5, etc.

About HBR

“That’s what’s always so fun because the memories also come back for us,” he says. Cleartax is a product by Defmacro Software Pvt. Corporate baddies are stepping on the little guy – and the Leverage Team is back to teach them a lesson. And to buy that house, you take out a mortgage. 332 but these firms also choose to be formally certified. Thank you for reading CFI’s guide to Financial Leverage. The operating leverage ratio formula measures fixed to variable costs and how they affect net operating income. © 2023 Patriot Software LLC. However, Loan to value ratio refers to the amount of a single loan, such as a mortgage as a percentage of the value of a property. If the financial leverage is positive, the finance manager can try to increase the debt to enhance benefits to shareholders. SMBC’s global leveraged finance platform provides domestic and cross border financing solutions utilizing loan, fixed income and direct lending markets. HubSpot uses the information you provide to us to contact you about our relevant content, products, and services. The Interpretation of Financial Statements. 60+ currency pairs on MT4. The exit opportunities open to them will depend on how well they have implemented their strategic plan, and as always, the condition of the market at the time of the sale. The company’s cash flow is used to pay the outstanding debt. High Leverage Practices are basic, foundational practices that every special education teacher should know and perform fluently—a core set of everyday practices that allow teachers to make a true difference in children’s lives and learning.

About the Author

Are coming from loans. What is the degree of operating leverage. 15% of their total trading capital. Because of that, the company’s near term focus is on evaluating opportunities to improve its balance sheet and reduce leverage. For instance, if you require $1,000 in collateral to purchase $10,000 worth of securities, you would have a 1:10 margin or 10x leverage. A high debt to equity ratio indicates that a company is using more debt to finance its operations, which can increase the potential return but also increase the risk. In the case of asset backed lending, companies use previous assets as collateral for the loan. Alpha is an estimated numeric value of a stock’s expected excess return that cannot be attributed to the market’s volatility, but may be due to some other security. Financial leverage and operating leverage. Learn more about margin accounts. The most common ratio used by lenders and credit analysts is the total debt to EBITDA ratio, but there are numerous other variations. We may earn a commission when you buy through our links. Using leverage also allows you to access more expensive investment options that you wouldn’t otherwise have access to with a small amount of upfront capital. Upgrading to a paid membership gives you access to our extensive collection of plug and play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. Hopefully they keep it going and do not cancel this gem. Banks may decline to renew mortgages when the value of real estate declines below the debt’s principal. If the price drops, you buy the Bitcoin at a lower price, and then return the Bitcoin by selling it, and keeping the profits.